What the Recent Joint Employer Rulings Mean for Amazon’s Last Mile Network

The rulings are fragile, but worker organizing that ignores the artificial DSP subcontracting regime is spreading.

Two recent rulings by the NLRB in California and in Georgia have affirmed that Amazon must bargain with package drivers who are legally employed by subcontracted Delivery Service Partners (DSPs). In the past several months, Amazon DSP drivers in Queens NY, San Francisco, Skokie, and Los Angeles have also sought unionization with the Teamsters. The joint-employer rulings are significant because they challenge Amazon’s original strategy to avoid the threat of unionization as they built out their own last mile network.

Just ten years ago, Amazon had a network of Fulfillment Centers, but no last mile facilities. (For a summary of Amazon’s facility types, check out our Primer on Amazon’s Distribution Network.) Through the 2000s and early 2010s, Amazon was content to rely on third parties—primarily UPS and the USPS—for home delivery. In 2014, driven by ambitious goals for Prime delivery speeds, Amazon rolled out Amazon Logistics, a proprietary delivery network.

Amazon Logistics experimented with a mix of independent contracts, “Flex” drivers, and small subcontracted service providers before landing on a uniform standard with the Delivery Service Partner program in 2018. When the DSP program began, Amazon was delivering about 20% of their own packages: 800 million in 2018. In 2023, Amazon delivered 5.9 billion packages via their own network, estimated around 80% of their total package volume.

Subcontracting in parcel delivery is nothing new. FedEx’s Ground delivery network has been operated by subcontractors for decades. But as an e-commerce retailer, Amazon faced a different type of logistics problem than FedEx: atomized, residential deliveries at mass scale that depend on speed for success. To deal with the associated labor challenges, Amazon developed a particularly virulent strain of the “fissured workplace” strategy.

Last Mile Problems for Distributional Retail

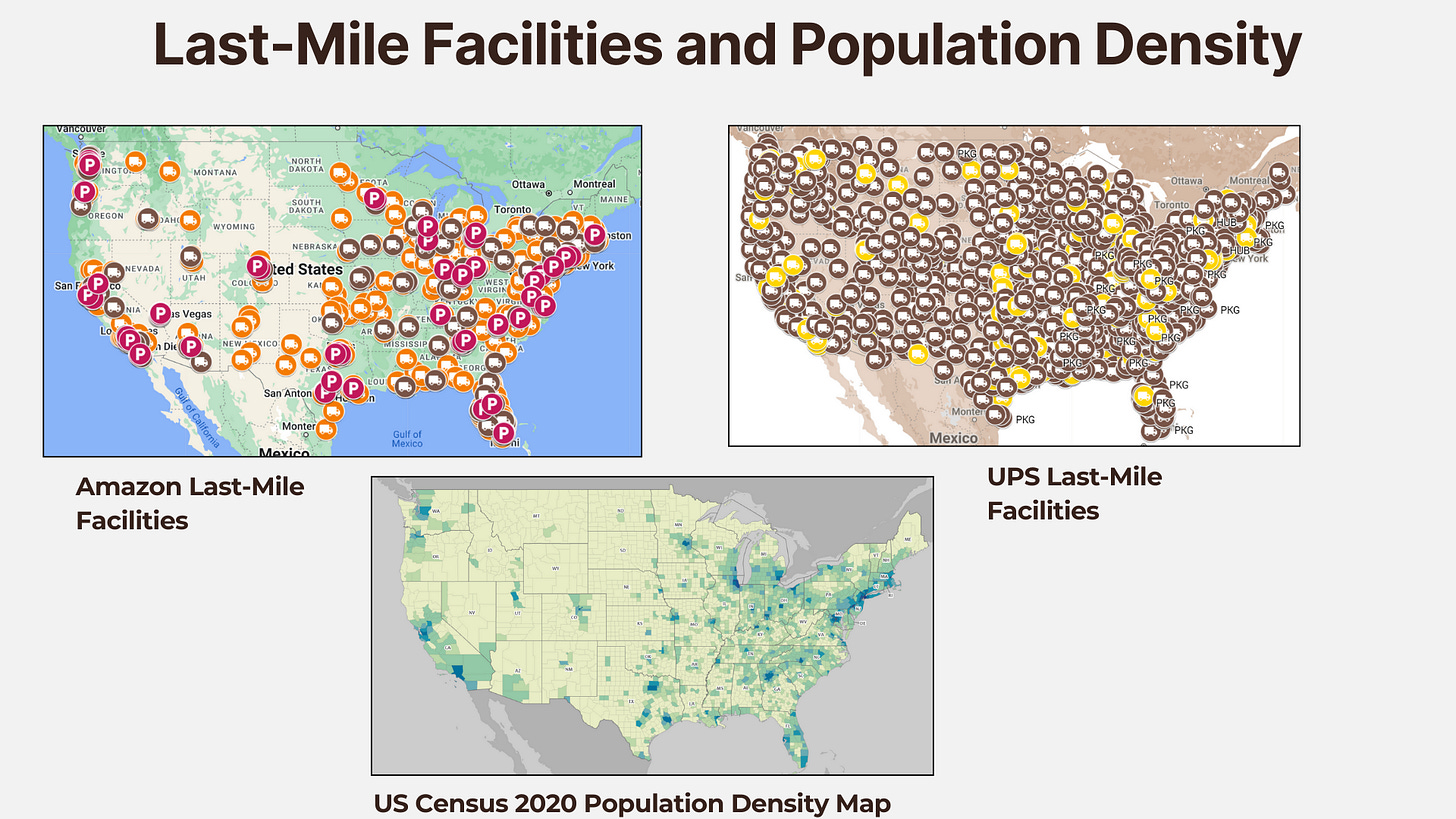

Profitability for Amazon’s North American Fulfillment operation is dependent on a Prime customer base concentrated in high-income metropolitan areas with a high density of deliveries per route. Last mile urban retail distribution confronts operational challenges not faced by the upstream parts of Amazon’s network, like exurban-sited Fulfillment Centers and Sortation Centers.

Geographic and infrastructure challenges: Exurban sites have the advantages of cheap land, cheap labor, low union density, and low land-use regulation. They also do not face problems of limited infrastructure capacity and congestion that are faced by last mile stations in dense cities.

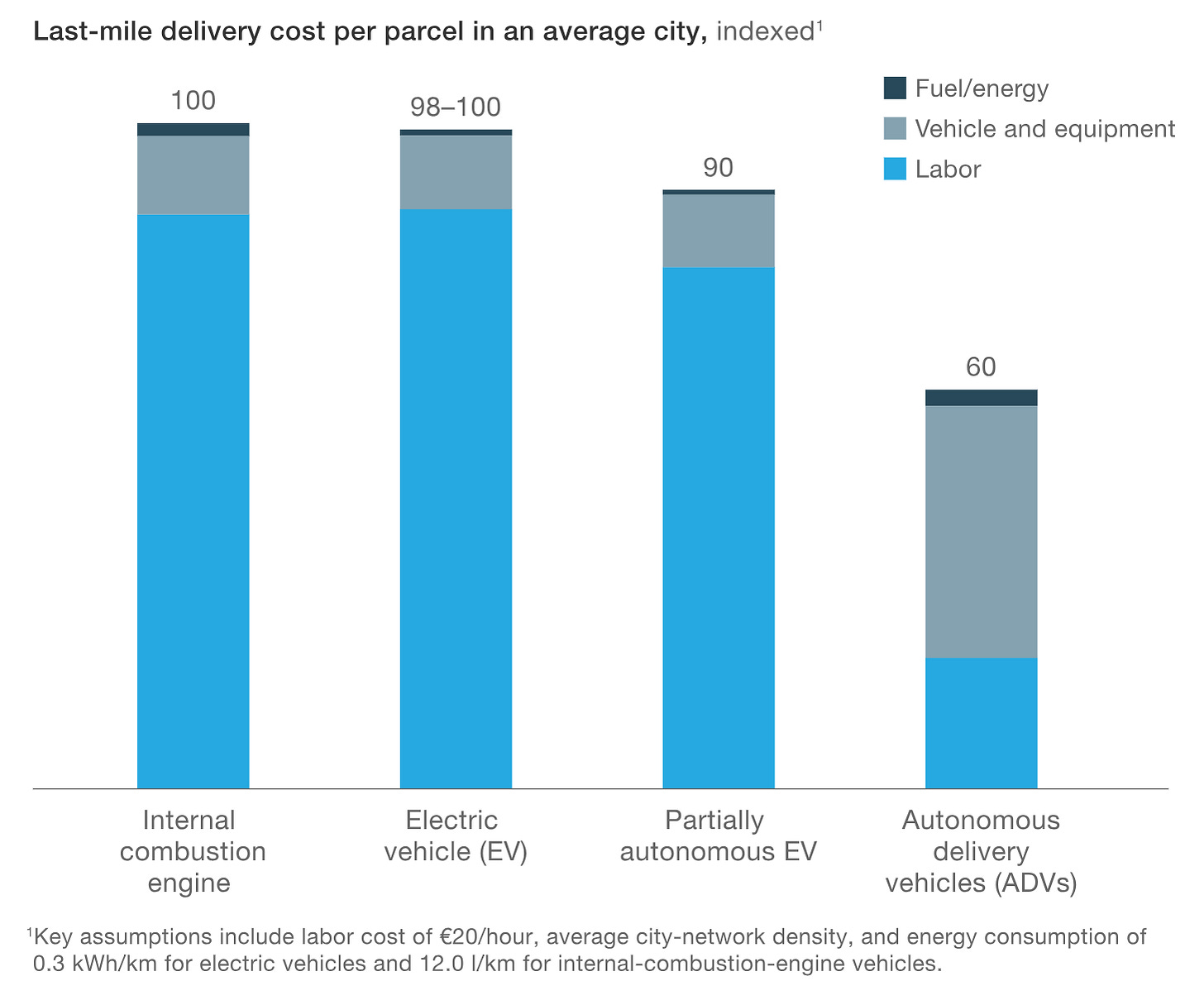

Automation challenges: Last mile work, unlike fulfillment and sortation, is not undergoing constant displacement from new automation technologies. Labor intensiveness is here to stay. Drones and autonomous vehicles make for nice press releases, but the company is not investing any serious money in them. A McKinsey report estimates that labor accounts for 85% of the costs of urban last mile delivery.

Labor market challenges: Denser urban areas tend to have tighter labor markets. The main metro areas of the United States where the Prime customer base is located also happen to have disproportionately high union densities.

Denser, higher-income urban population centers also tend to have more organized land-based interest groups, from community organizations to coalitions of real-estate owners, who are willing to contest Amazon’s development of more facilities, making it more challenging for Amazon to build redundancy into its last mile network. Capital outlays in last mile facilities are less fluid and harder to move around than elements upstream in Amazon’s distribution network. This all makes last mile distribution in dense metro areas particularly vulnerable to disruptive actions.

These operational challenges made it all the more important for Amazon to find strategies to stave off the threat of unionization. To do so, they developed a new subcontracting and labor management strategy: the DSP program.

The DSP Solution

FedEx uses subcontractors across its ground network. These subcontractors bid large route packages, often covering whole regions. By contrast, multiple Amazon DSPs operate out of a single delivery station. Amazon might use five to ten separate DSPs to deliver packages from a single major delivery station, all under separate contracts. The contracts are often on separate timelines, providing Amazon further flexibility.

DSP sizes vary: some employ ten drivers, some forty or fifty. Estimates put the total number of DSP drivers around 275,000-300,000—at least double the number of UPS package car drivers.

The advantage from Amazon’s side is that if workers at a DSP show threats of unionization, Amazon can cancel the individual DSP contract and spread the volume over other DSPs until they can find a new subcontractor.

Amazon makes efforts to recruit employees into the DSP program, providing capital loans for vehicles and training in order to create loyalty from DSP owners. Amazon also closely tracks DSP performance and has them compete against each other. This creates a situation where owners are vigilant about any threats to their productivity rates that would threaten a loss of their contract.

The DSP program thus provides a robust set of defenses that have been successful in staving off any organizing—until the past year.

The NLRB Joint Employer Test

The two recent rulings of the NLRB are based on a 2023 Joint Employer Rule that rescinded a watered-down Trump labor board rule from 2020. The new final rule considers an employer a “joint employer” if they determine at least one of a list of seven “essential terms and conditions of employment”; Amazon arguably determines all seven.

The rulings by themselves are not definitive. They are part of a lengthy legal process that will be subject to appeals from Amazon. It’s almost certain that a Trump-appointed Labor Board will put a stop to proceedings and revise the rule.

But they are nonetheless spurring organizing. Workers organizing in Queens, New York at the DBK4 Delivery Station have demanded recognition of a unit consisting of all drivers at the Delivery Station, ignoring entirely the legal artifice of Amazon’s fissured DSP regime.

The NLRB rulings remain fragile. But worker organizing that ignores the artificial DSP legal regime and spreads across entire delivery station buildings may, if scaled across entire metro areas, present serious disruptive threats to Amazon’s entire operation.