The Distribution Networks of Canada’s Large Employers

With some particular interest in the dense warehousing cluster in the western Toronto suburbs…

Last September, the Canadian union Unifor announced that they had organized the workers at one of Walmart’s Regional Distribution Centers in Mississauga, Ontario. It was a truly stunning announcement, given how successful Walmart has been at fending off organizing threats over the years.

It turns out that Walmart RDC is one of four large Walmart facilities that are basically right next to one another, all occupying a roughly 3 square mile area.

Wanting to know where this Walmart cluster fit within the larger warehousing geography of the Greater Toronto Area, I mapped out the distribution networks of five of the largest employers in Canada, including Loblaw (220k workers total), Empire (128k), Walmart (100k), Costco (53k), and Amazon (46k).*

American readers will be familiar with the latter three. Loblaw Company runs a giant network of supermarket chains, including Atlantic Superstore, Dominion, Loblaws, Maxi, No Frills, Provigo Le Marché, Valu-Mart, Real Canadian Superstore, Wholesale Club, Your Independent Grocer, and Zehr, with about 2,500 locations. Empire is basically the same thing, but their brands include Sobeys, Safeway, IGA, Foodland, Farm Boy, FreshCo, Thrifty Foods, and Lawtons Drug.

Applying the logistical cluster definition I recently used with the “distribution mega-map,” i.e. a roughly 25 square mile area with at least five warehouses representing at least three large retailers mentioned here, there are 4 logistics clusters in Canada. The first is just northeast of the Calgary airport:

The other three are all in the Toronto suburbs, and the first, centered around Ajax, barely qualifies:

The other two, in the western arc of Toronto suburbs from Mississauga (where those Walmart facilities are) through Brampton to Vaughn, are the real prizes, and any serious warehouse organizing campaign is going to be zeroed in on this area.

Here’s the larger map to see how these two are situated next to one another.

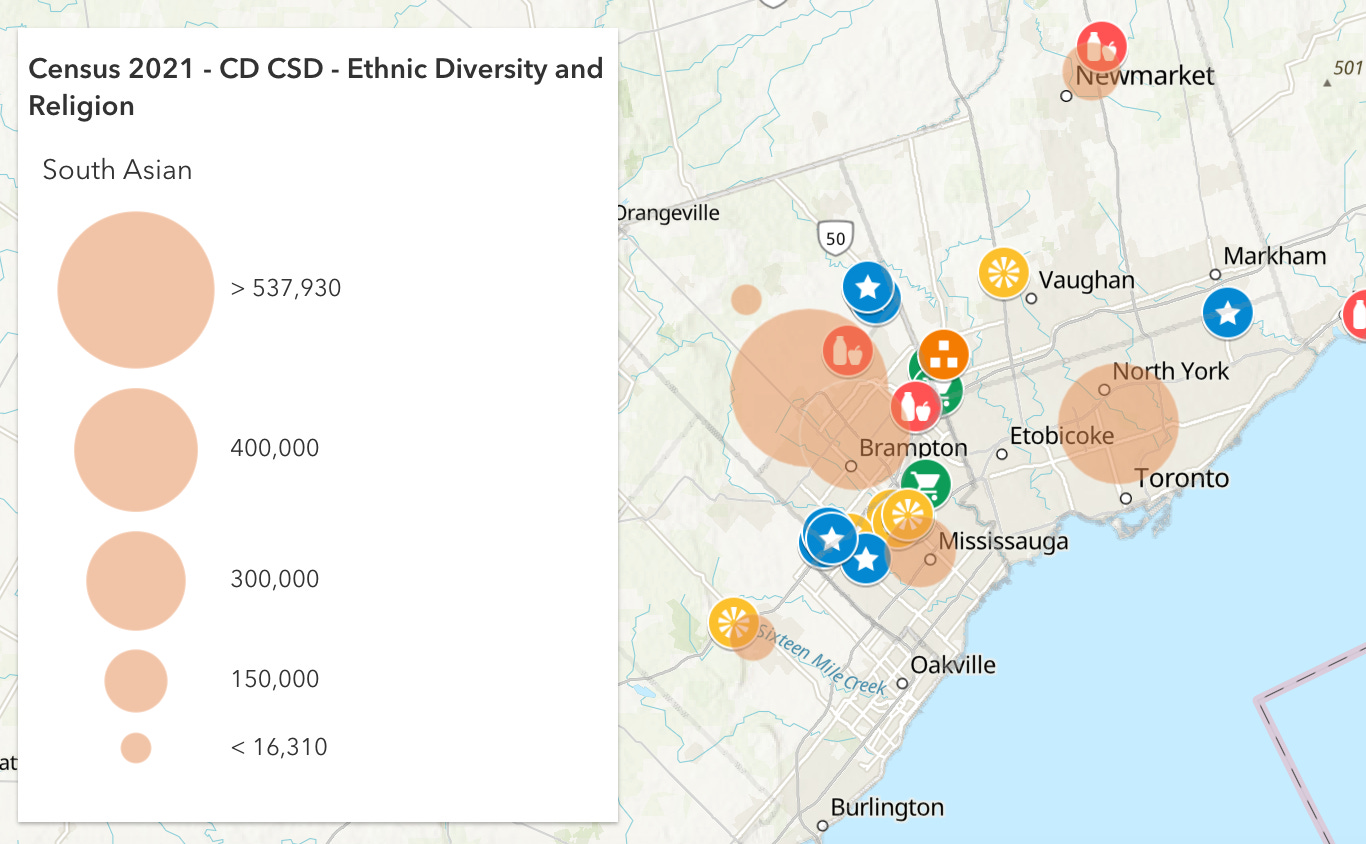

The Brampton area is known for having a large South Asian, and in particular Punjabi, population. Here’s that same map but showing the community clusters of Punjabis, and then South Asians generally (from the 2021 Census data):

Tackling warehousing and distribution operations in the United States is a massively complicated affair; where and how to start, not an easy conversation. In Canada, by contrast, it’s pretty straightforward where the focus should be. It’s very promising that Unifor already has a foothold there, but as with Amazon, we should imagine Walmart as willing to do just about anything to ensure that that foothold does not develop into a real entry point for unionism.

*I’m pretty confident in the Amazon and Walmart parts being complete: the Amazon part is from MWPVL, and what I was able to find so far for the Walmart facilities pretty closely matches how they describe their distribution network. Loblaw claims to have 27 facilities in total, but I was only able to find 19. Sobeys claims 28, and I was only able to find 22. Both appear to use 3PLs for a handful of their distribution centres, and my guess is that the missing ones are third party.