To close out 2024, I thought a distribution network mega-map was in order, combining some of the work I’ve done this year with the brief primers series. Having the maps on their own is interesting and useful, but the real fun will begin with their combination and application.

I’m going to start including the data files for all the map work with each article (down at the bottom), and I’ve also recently created a new page just for data. If you know any ArcGIS or data nerds who might put this to good use, please send along, and in general, share On the Seams with your friends to get us some new subscribers.

In this mega-map are all of the container ports in the US, all of the Class I rail intermodal terminals, the top 100 cargo airports by landed weight, and the top 100 trucking bottlenecks. Again, all of the data is linked at the bottom.

I’ve also included all of the distribution facilities (minus air cargo airports and last-mile facilities in the case of Amazon) for the four largest retail employers in the country: Walmart, Amazon, Target, and Home Depot.

Now this is a mess of a map in one sense, but it does allow us to see some of the relations between these facilities, specifically their clustering around air cargo hubs and intermodal terminals. And this in turn allows us to better understand how we talk about logistical agglomeration.

“Logistics cluster” is a pretty nebulous term. Sometimes it refers to all of the warehousing operations within a discrete logistics park, as in the case of CenterPoint Intermodal Center in Chicago or AllianceTexas in Fort Worth. But sometimes it just means a whole bunch of things right next to one another, as in the case of the I-78/I-81 corridor in the northeast. The term “inland port” is sometimes thrown in there as a synonym.

There’s no one right way to define it, but it’s worth fixing some variables with a map like this and seeing what happens. If, say, we defined a logistics cluster as any 25 square mile area where at least 3 of the 4 giant retailers just mentioned have facilities, and where there are a minimum of 5 facilities, what do we find? Well, if that’s the case, there are 23 logistics clusters in the United States, and here they are.

The Big Ones

The biggest concentration of warehouses is unsurprisingly in the Inland Empire, CA, where I found three such clusters (in everything that follows, I’ll be using the definition above for “cluster,” i.e. a 25 square mile area with at least 5 facilities representing at least 3 of the 4 retailers): one around the Chino airport, one at the intersection of I-15 and US-60, and one around the KRIV air cargo hub.

Another big concentration is southwest of Chicago around the aforementioned CenterPoint Intermodal Center (CIC), the largest such intermodal facility in the country. CIC has two major intermodal terminals, one in Joliet, IL and the other in Elwood, IL, and there are two clusters around them.

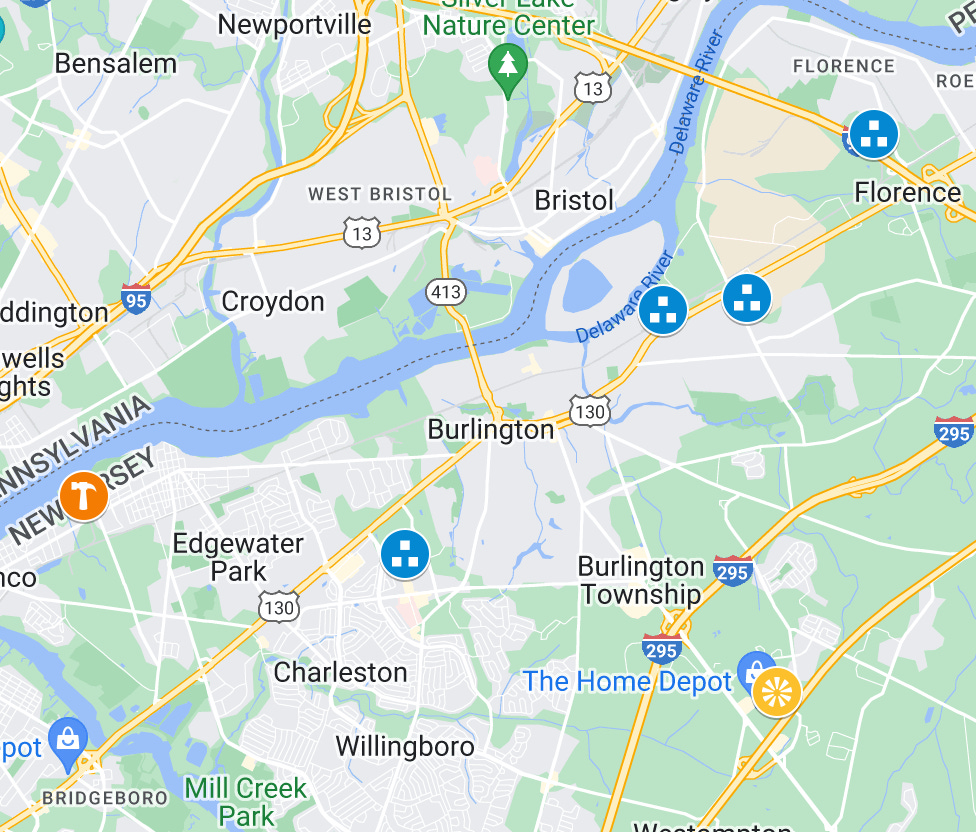

The final area of concentrated clusters is in the I-78/I-81 corridor from Hagerstown, MD to Scranton, PA, where I found three clusters. Looking at the number of truck bottlenecks along I-95, it’s clear what a relief valve the I-78/I-81 corridor is for the densely packed east coast market.

Known Clusters

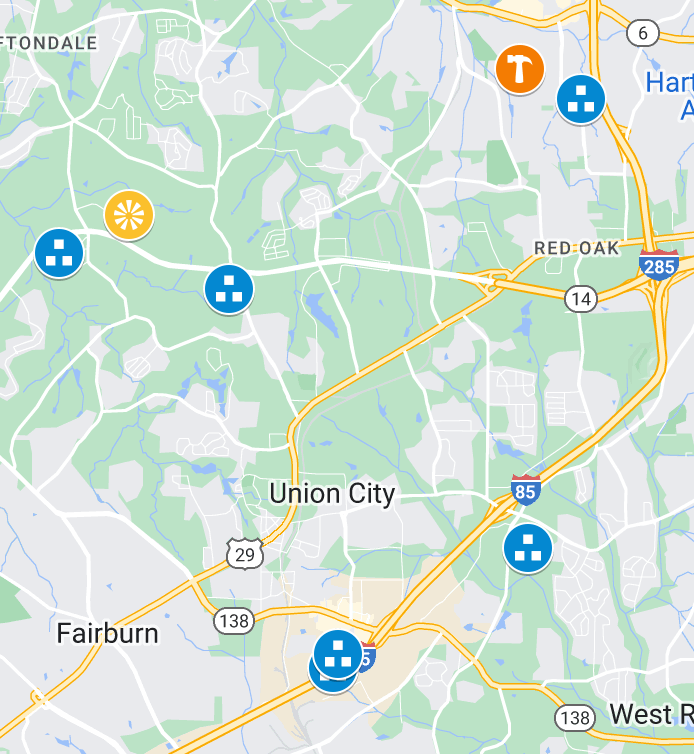

The Dallas/Fort Worth, Houston, and Atlanta areas are known concentrations of logistical operations. There is one cluster in Dallas, and one in Houston. There are two in Atlanta, one of which is dominated by Home Depot facilities (Home Depot is headquartered in Atlanta).

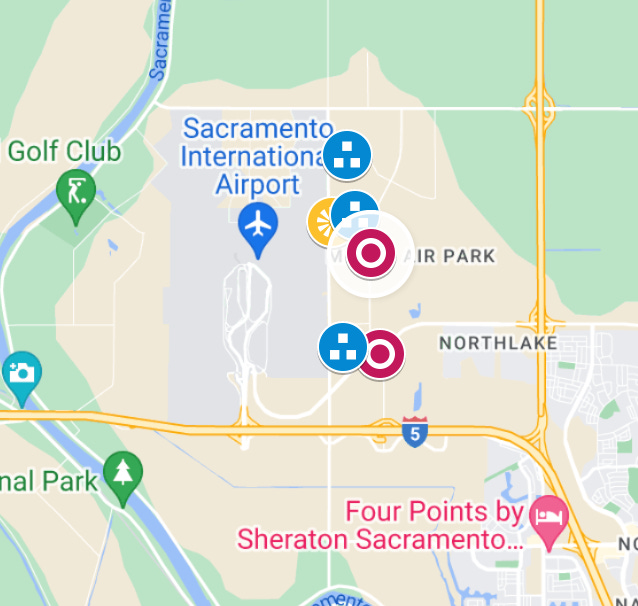

Cargo airports also tend to have significant logistical clustering around them. Most notable here is the one around the Indianapolis airport, which is Fedex’s national hub.

And then finally there are the scattered clusters along the very congested I-95 corridor.

The Rest

Here are the remaining five clusters, some of which just barely meet the criteria listed above.

Some Concluding Thoughts

This is but one way to carve things up. There’s good reason to set the parameters this way, as it’s likely that there are many other warehousing facilities in these clusters if they meet the defining criteria. Perhaps it would help to add the hubs of the big parcel companies or the distribution centers of other large retailers or 3PLs. It would also be interesting to add in facility differentiation here, seeing the differences between e-fulfillment center locations and traditional distributional node locations.

One thing that really stands out to me here is that 2 of the 23 clusters are within a single, privately-owned facility: CenterPoint Intermodal Center (CIC), which will get its own write-up soon. If there is a testing ground for thinking through how logistical agglomeration might be tackled by the labor movement, it is CIC.

And finally, here’s the data from the map. The big retailer data is compiled from the individual layers of those other distribution network maps, which I’ve recently included on our new “Data” page.

You overlooked a new Amazon center: PVD2 near Providence, RI

https://maps.app.goo.gl/yMRHyfi6APHfPUUMA