The big retailers and parcel companies are mostly tenants at their distributional facilities. Amazon is the largest industrial tenant in the country, with almost 400 million square feet leased. It is starting to buy more of its own property, but it’s still a tenant at 90%+ of its warehouses. Home Depot generally owns its stores but leases its warehouses. Fedex and UPS both lease about 80% of its facilities. Walmart is the exception to the rule here, owning about ⅔ of its warehouses and leasing about ⅓.

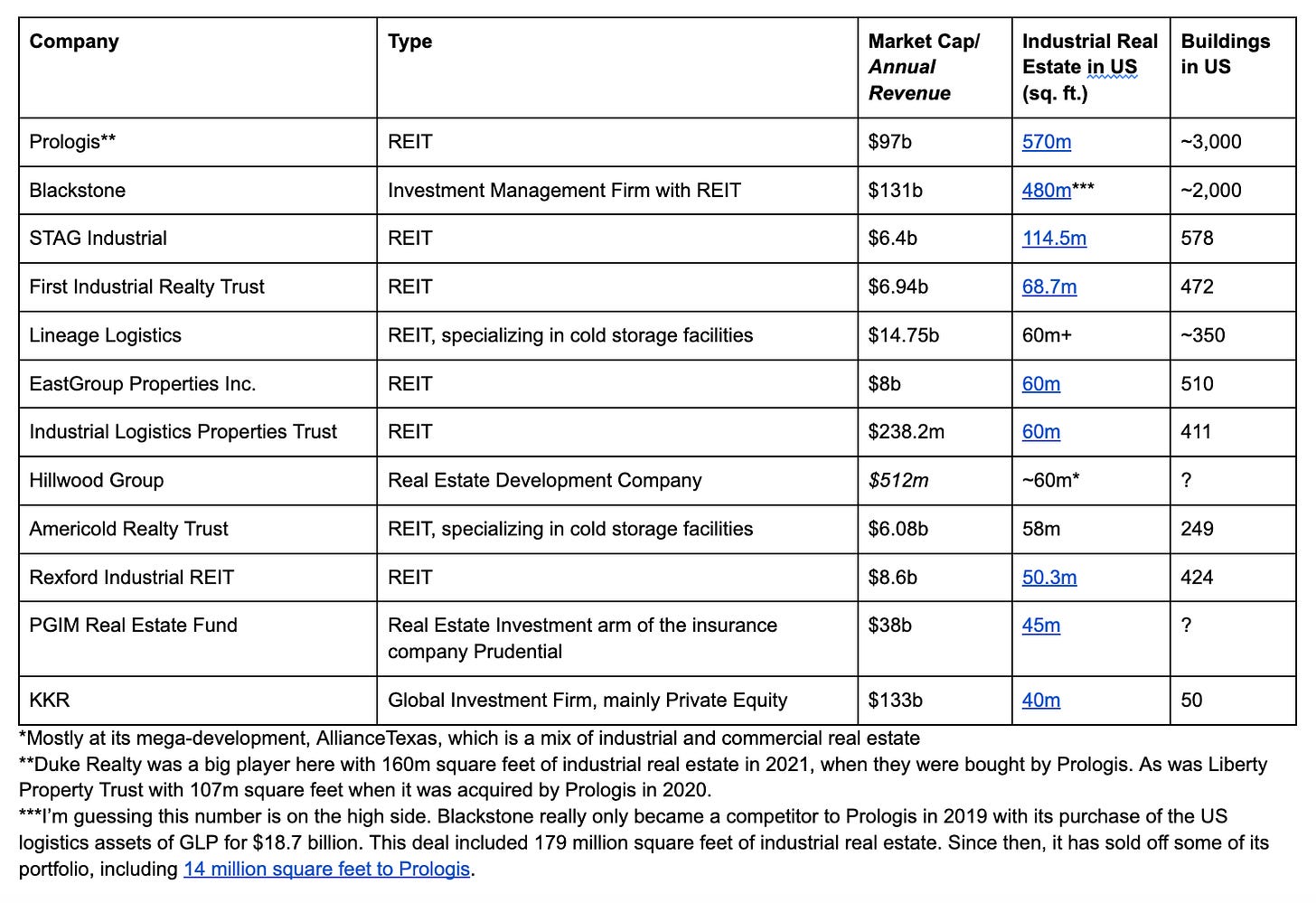

So who then owns the warehouses? The short answer is mostly Prologis and Blackstone, which have gobbled up more than 1 billion square feet of industrial real estate between them. But there are other key players in the market, and I’ve listed any that own at least 40 million square feet of industrial real estate in the US below.

Warehouse ownership changes about as quickly as logistical operations themselves. Cole Real Estate Investments had 120 million square feet of industrial space in 2012, making it second in the industrial space only to Prologis. In 2013, it was bought by American Realty Capital Properties, which changed its name to VEREIT in 2015 after an accounting scandal. In 2021, VEREIT was then acquired by the Realty Income Corporation, which owns about 335 million square feet of commercial space, and about 14% of their rent is collected from industrial space—meaning that their total industrial footprint is probably under 40 million square feet today. So somewhere along the way more than 80 million square feet of industrial real estate changed hands.

Note that this list just includes the owners of industrial space, not the asset managers with large industrial portfolios, or the managers or developers of industrial spaces. I’ll work up a separate short piece on the latter. Note also that it just pertains to the vague category of “industrial” space, so not all of the square footage below is devoted to distributional operations.