UPS is not doing well, but...

It's still in a better position to be able to deliver universal parcel coverage than Amazon.

*Note: the following article was made possible by updating my Brief Primer on UPS’s Distribution Network, which is here.

The announcements from UPS in the past year and half do not portray a thriving company. In January 2024, they said they were cutting 12,000 jobs. In March 2024, they announced that they were closing 200 distribution facilities over three years, as part of the creation of what they’ve deemed “The Network of the Future.” As implied, this will indeed involve the opening of new, larger, more automated hubs, but layoffs are still part of the picture.

Then recently, just in April, they announced they were closing 73 facilities by June 2025, involving 20,000 layoffs. It’s unclear whether these cuts were already part of the plan laid out last year but just on an accelerated timeframe, or whether they’re new cuts, but either way, it’s not great, and it underlines something I’ve been mentioning in almost everything I’ve written lately: the conditions for 2028 negotiations over the master contract between UPS and the Teamsters are going to be very, very different than they were in 2023.

None of this bodes well for the Teamsters, and given that this is the largest union contract in the country - a round of concessionary bargaining for which would resound throughout the union world - none of this bodes well for the labor movement as a whole.

Even with all of these cuts, however, it’s important to keep in mind that UPS is still an enormous and very capable parcel company and that, at present, it bears the capacity for more universal service coverage than Amazon. This matters because Amazon has been furiously building out its rural delivery network in the hopes of being a viable bidder should USPS be privatized. And it’s possible with their giant capex that they will soon surpass other parcel companies in this regard - more on this later - but it hasn’t happened yet.

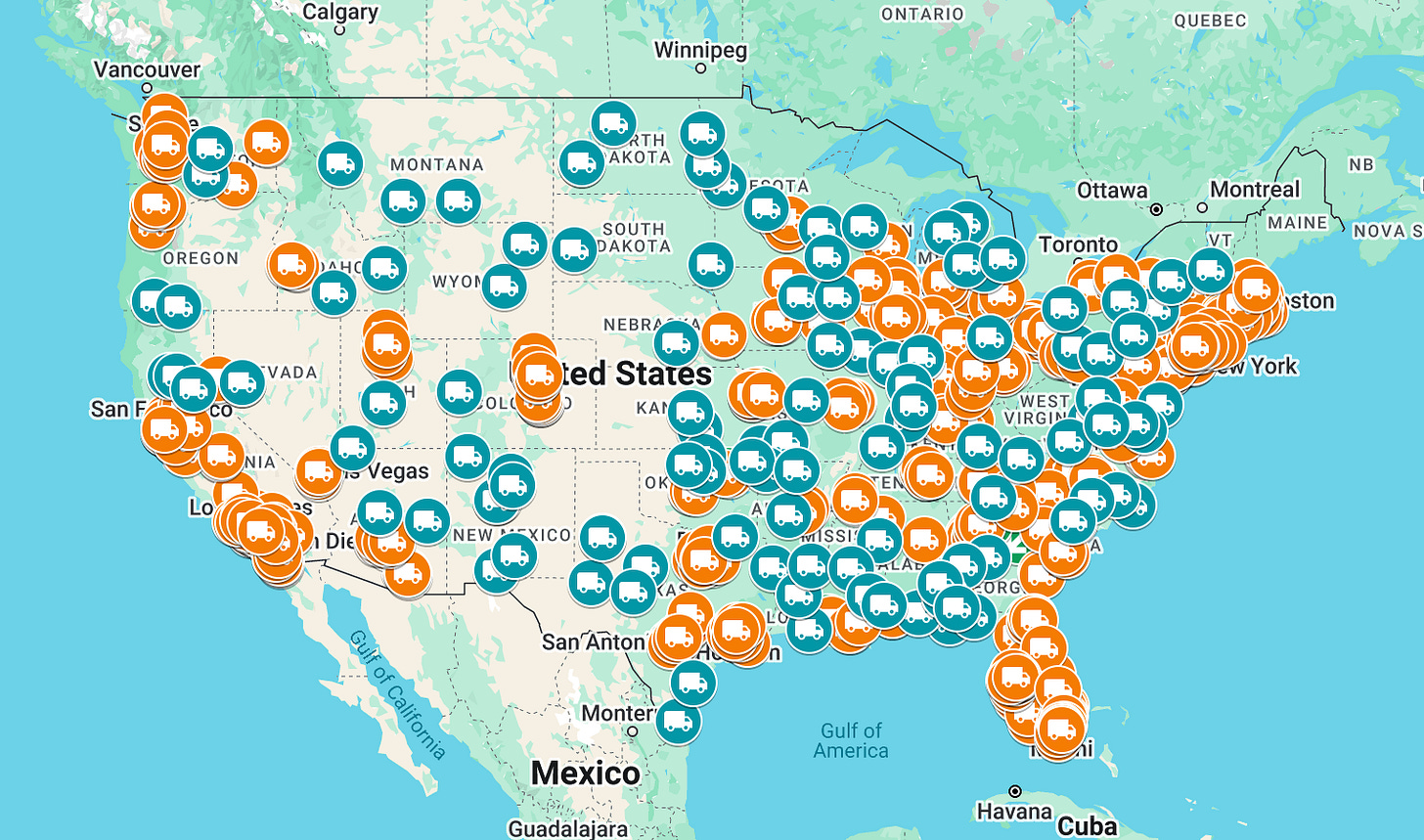

The differences are visible in the maps themselves. Here’s a (recently updated!) map of UPS’s package hubs and centers:

And here’s a map of the functionally equivalent facilities in Amazon’s network:

UPS might be slowly balding, but it’s still got a thick head of hair, while Amazon’s just getting past its baby hair.

Note that this is just about coverage and not about volume. In 2023, Amazon leapfrogged UPS in terms of overall package volume, but the company is overwhelmingly concentrated in urban areas and will oftentimes dump its rural packages into UPS and USPS streams. USPS is governed by what’s called a “universal service obligation” (USO), which means it must delivery packages everywhere and relatively affordably. Any company that bids on USPS privatization will need to demonstrate its capacity to meet this USO, and Amazon is still quite behind in this regard.

By my current count, UPS has 745 package centers and 265 package hubs, and this does not include centers and hubs that have recently been closed or announced to be soon closing. My spreadsheet of recent UPS closures is below, and I’ll be updating it with WARN data soon. For the moment, I’ve just included anything mentioned in the news or on what seem to be the more credible Reddit threads - which is to say, it’s possible I’m overcounting closures and thus undercounting centers and hubs. Of the 1,010 distribution facilities counted in UPS’s network, I’ve verified every single one either with OSHA’s 2024 Injury Tracking Application data or with a phone call.

Amazon, by contrast, has 601 delivery stations, of which 119 are rural “wagon wheels,” and 118 sortation centers. So both in terms of overall count and in terms of rural coverage, Amazon still trails behind UPS.

This does not even get into the problem of two-way logistics, which Amazon has only recently begun to solve. For the most part, packages go through Amazon’s distribution network in a single direction: from Fulfillment Center to Sortation Center to Delivery Station to your residence. For UPS and Fedex, by contrast, packages are also coming in from a great number of places. Amazon does have Amazon Shipping and some limited capacity there, but it’s nothing compared to UPS’s and Fedex’s, which have stores/drop-off points all over the country.

This is all to say that even after recent cuts, UPS is still a giant parcel company, and it’s still in a way, way better position to offer USPS-like service than is Amazon. If we meet the dire day when USPS is privatized and Amazon is rewarded in any way as a result, it will be as a true political favor and not because Amazon is capable of delivering on the USO.

Now you might agree with me that UPS is currently way ahead of Amazon as a true parcel company, but that Amazon’s soon going to catch up given how quickly they’re building these rural facilities. In 2024, they added 47 delivery stations (including 17 rural “wagon wheels”) and 3 sortation centers to their network. On this trajectory, it would still take them more than four years to match UPS’s hub and center facility count, and unless they really devoted themselves to the rural buildout, they’d still be more concentrated around population centers than UPS. And again, this is not even taking into account the problem of reverse logistics.

You might further object that Amazon is bound to surpass UPS given UPS’s current trajectory. Perhaps the company is cratering in ways of which I’m not aware, but as I cover in the primer, there are legitimate inefficiencies that “The Network of the Future” is addressing, so it’s not all about cuts. Some of the “closures” that you might read about are actually temporary closures for automation upgrades, which will inevitably mean layoffs but not true dips in network capacity.

So Amazon might be doing a remarkable number of things astonishingly well, but it’s still not the parcel company that UPS is - at least for the moment.