A Brief Primer on Target's Distribution Network

The third largest employer in the country is engaged in a unique metro sortation hub buildout

As of the latest 10-K numbers, Target is now the third largest employer in the United States (a distant third after Walmart and Amazon), which is a bit concerning because Target’s net sales have also dropped the last two years, while those of Walmart and Amazon have seen comfortable growth. As a recent scathing Barrons piece describes their situation,

Once viewed as a retail winner, Target has suffered from a dearth of merchandise, skimpy staff, messy stores, and even its approach to diversity, equity, and inclusion policies. These problems have left the storied retailer in a precarious position, fighting not just for growth but also for its place in a hotly competitive U.S. retail market dominated by innovative, well-capitalized giants such as Walmart, Costco Wholesale, and Amazon.com. Target's stock, reflecting those troubles, has dropped 43% over the past three years.

It doesn’t seem like Target is taking any of this lying down, as it has recently set the goal of more than $15 billion in sales growth by 2030, is adding a lot of new items to its product catalog, is revamping its Circle 360 membership plan (like Prime membership), and, most pertinently for me, is actively reworking its distribution network. Though e-commerce and traditional retail have very different logistical architectures that don’t typically mesh, I’m not convinced that Walmart and Target’s “store as last-mile hub” strategy is inherently a loser, and Target’s metro sortation hub buildout (see below) seems to be a real logistical breakthrough for this strategy.

As with all of our brief primers, this one comes with a map of Target’s distribution network. Please email any updates you might have to ontheseams.newsletter@gmail.com.

Import Distribution Centers

Like Walmart Import Distribution Centers or Amazon Inbound Cross-Docks, Target’s Import Distribution Centers receive full containers from the ports and prepare goods to be sent to Regional Distribution Centers. Some Target containers are sent to third-party de-consolidators, which transfer goods into full truckloads bound for IDCs.

Target owns the buildings for its massive IDCs in Suffolk, VA (1.8 million square feet), Savannah, GA (2 million square feet), and Rialto, CA (1.5 million square feet), each of which employs about 1,600 people.

Regional Distribution Centers

Target’s Regional Distribution Centers function essentially like Walmart’s, receiving goods from suppliers, storing them, and distributing them to stores. RDCs only receive in full truckloads - anything less is sent to third-party consolidation points before heading to RDCs.

One part of the RDC is a cross-dock for fast-moving items; the other, larger area is equipped with 6-8 miles of conveyor belt. Inbound items are scanned and sorted onto this belt with Target’s “Automated Receiving Technology” system, which directs these items either to be stored in inventory or directed to outbound trucks.

RDCs are about 1.5 million square feet in size and generally employ about 1200-1500 people each; Target’s largest RDC in Logan Township, NJ employs 2584 people on average, per 2024 OSHA ITA data.

Food Distribution Centers

Target is the ninth-largest grocer in the United States and the fifth-largest in terms of online sales, but it’s trying to grow its food segment, recently announcing the construction of three new food distribution centers.

Target has partnered with Swisslog and Witron to automate its food distribution centers. At certain FDCs it uses Swisslog’s CaddyPick system, a “a semi-automated order picking of mixed case pallets… applicable in ambient temperature and chilled warehouse zones.” Other FDCs have used Witron’s more extensive automation solutions, described by MWPVL here.

E-Commerce Fulfillment Centers

Target currently has 14 dedicated E-commerce Fulfillment Centers, though I’m not sure why precisely, as they claim that at least 95% of their online orders are fulfilled from stores (this source says 97.6%!). My guess is that the number of E-Commerce Fulfillment Centers is going to go down now that Target seems to have settled on the Metro Sortation Center buildout.

E-Commerce Metro Sortation Centers

75% of Americans live within 10 miles of a Target store, making it seem like using stores as last-mile hubs would be a great idea. But a) making your store into a last-mile facility puts extra strain on existing retail staff, degrading the in-store experience, and b) sometimes an item desired by a particular customer within 10 miles of your store just isn’t at your store.

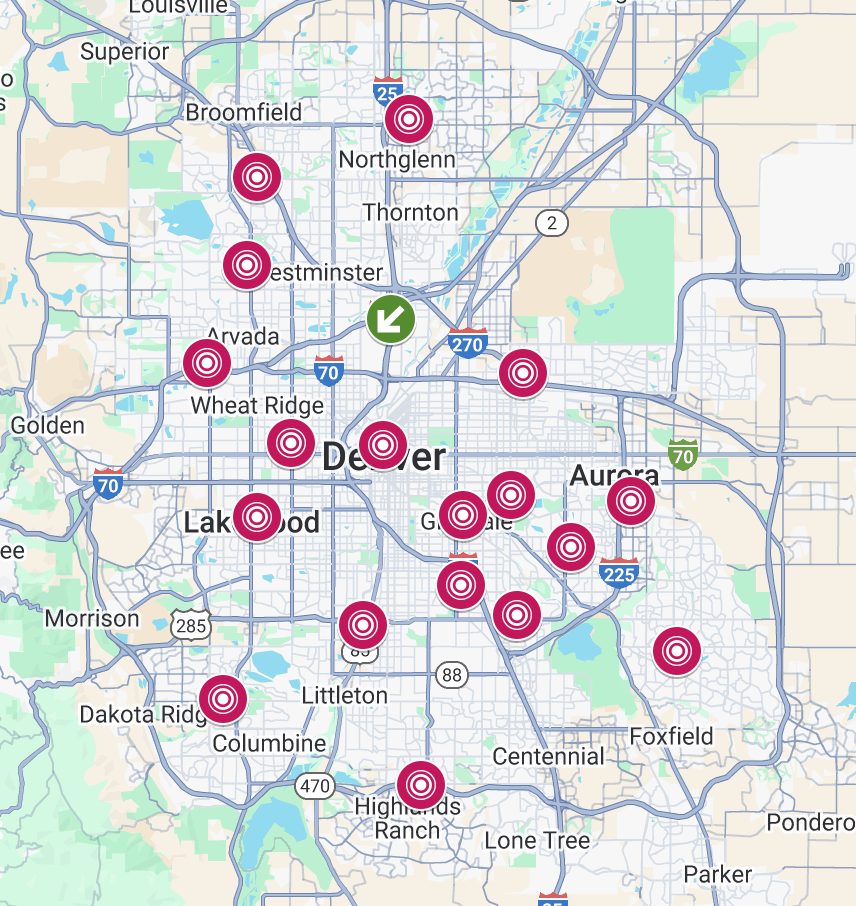

The E-Commerce Metro Sortation Center buildout is meant to address both problems. In it, online orders are collected from all stores in a region and sent to a sortation hub where they are sorted by area for delivery, often by the gig-work carrier Shipt (which Target owns). Here are the Denver Metro area stores (in red) and its sortation center (in green):

As an example, if someone in Broomfield, CO orders a particular item that is only available in the Highlands Ranch store, rather than have a driver travel all the way from Highlands Ranch to Broomfield (42 miles, more than an hour through Denver) with it, the item is gathered at a regular pick-up time by a driver going from store to store getting all online orders, and then batched by geographic area at the sortation center in Denver. Maybe the item goes to Westminster store if it has a last-mile function, or maybe it gets picked up by a Shipt driver for delivery directly from the Denver sortation hub, along with other orders in the Broomfield area.

It’s not rocket science, but it’s a real bridge technology between traditional retail and e-commerce. Target’s announced an investment of $100 million by 2026 in these sortation facilities, which would bring them up to 15 of them. It’s also piloted what it’s called a “Target Last-Mile Delivery Extension” (TLMD) facility in Smyrna, GA. It’s essentially a Delivery Station - a cheaper investment than a full Sortation Center.

One other note on Target’s last-mile operation: the Barrons article cited above makes an interesting suggestion for Target’s renewal, which is to double-down on its staff-intensiveness: while having existing store employees do online order fulfillment keeps them from maintaining the in-store experience, adding dedicated back-of-house fulfillment workers could allow Target to do both well. As many retailers look to automate away more and more work, chasing the promise of the AI revolution, it’s an interesting “zag” suggestion: just hire more people rather than spend a ton of money on automation. Not a terrible idea!