A Brief Primer on Home Depot’s Distribution Network

The largest home improvement retailer in the world is rapidly getting larger

*Updated: June 29, 2025

Home Depot is the largest home improvement retailer in the world. It has more than 2,000 stores and employs more than 400,000 people in the United States. Each store stocks between 30-40,000 items. Most of its revenue (97%) comes from merchandising, and 3% comes from its services (like home installation).

Home Depot was founded in 1978, and for its first thirty years, individual stores largely received goods directly from vendors, leaving inventory decisions to the discretion of store managers. In 2008, they began rolling out the Rapid Deployment Centers to centralize their supply chain and roughly since 2015 they have been optimizing their distribution network through the creation of specialty nodes with the aid of their Supply Chain Sync software, which allows “individuals at each step of the chain [to] view exactly what is on every truck, materials needed to unload, and diagrams of how to position carts/pallets to minimize touches/footsteps.”

In 2018, Home Depot announced a $1.2 billion investment in its distribution network by 2023. The aim was to open 150 new facilities in order to reach 90% of customers with same- or next-day delivery. Before this investment, its outbound network was fragmented between store-based delivery, online delivery from fulfillment centers and vendors, appliance delivery, and Interline brands delivery. By building out Flatbed Distribution Centers and Market Delivery Operations (explained below), and expanding their Direct Fulfillment Center network, the aim was to integrate these delivery modalities.

This investment just so happened to coincide with the Covid-19 pandemic, during which time Home Depot’s sales skyrocketed. Between 2020 and 2023, its revenue jumped from $110 billion to $157 billion. As FreightWaves characterizes this growth,

When we look back at what happened during the pandemic, we will see changes that were accelerated by COVID, and we’ll see fleeting developments that were induced by COVID, but we’ll also see longer-lasting structural changes to behavior, including home improvement, in part due to migration from cities but mostly from remote work. Whether in a hybrid model or fully remote, working from home is sticky and Home Depot loves it.

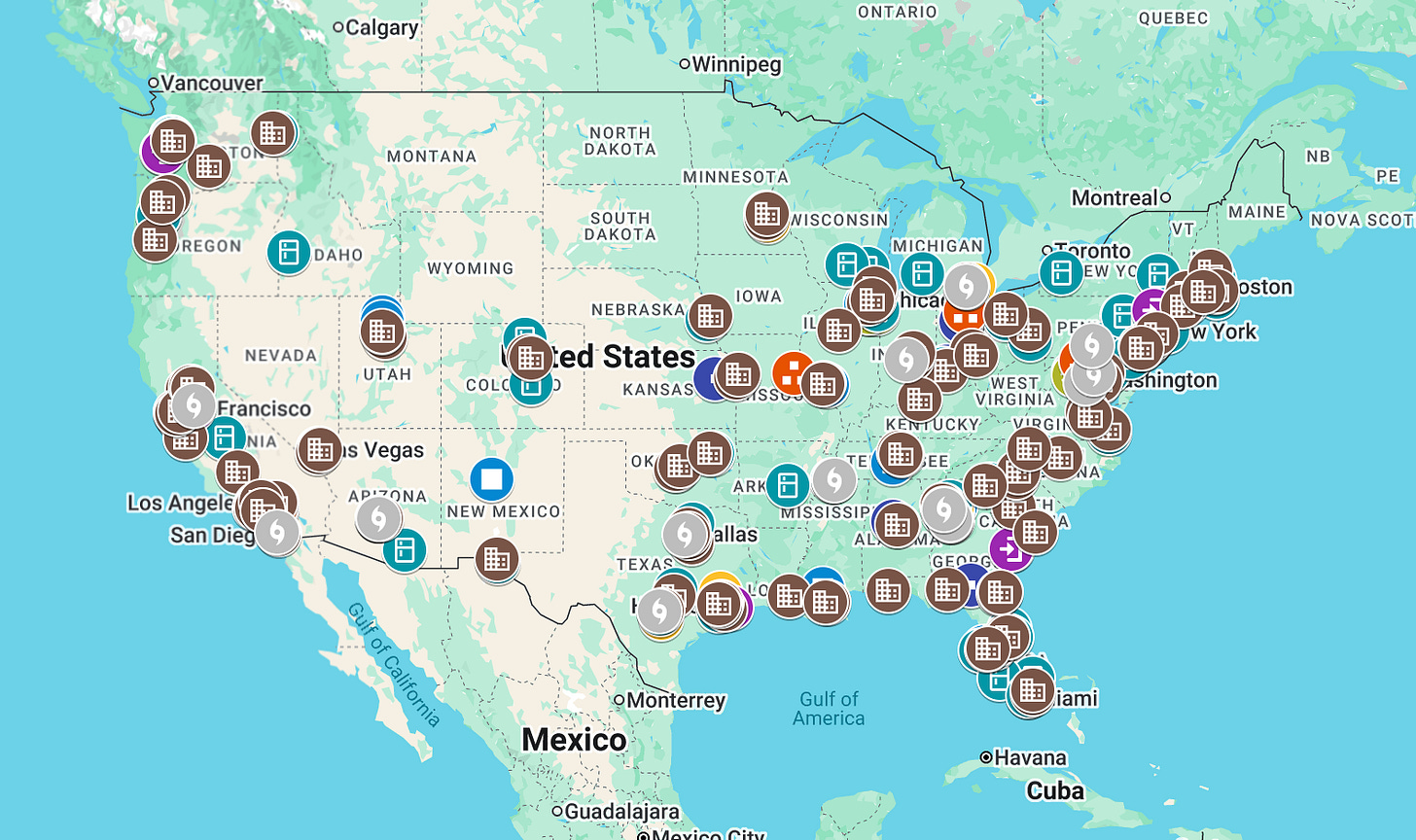

As with all of our distribution network primers, this one comes with a map of Home Depot’s distribution network. As you can see in the map, there are a number of distribution centers where we don’t know what role the facility plays. As always, please do help us out by emailing ontheseams.newsletter@gmail.com with any updates here.

Import Distribution Centers

Home Depot has seven Import Distribution Centers, all close to ports and broken into three regions (east, south, west). These are large facilities (800,000 to 1.5 million square feet) employing 140 people each, on average.

IDCs sort and send goods to one of four types of distribution center: Rapid Deployment Centers, Stocking Distribution Centers, Bulk Distribution Centers, or Flatbed Distribution Centers.

Rapid Deployment Centers and Internal Freight Consolidators

Rapid Deployment Centers (RDCs) receive goods from suppliers and IDCs and (rapidly!) distribute them to stores. They deal specifically with high-turnover items that need to be constantly replenished at stores.

Internal Freight Consolidators also receive goods from suppliers and IDCs, but they consolidate them to be sent to other RDCs or SDCs. As an example, rather than send their goods directly east, suppliers in southern California will send their stuff to the Redlands, CA IFC, which consolidates items in full truckloads and sends to an east coast RDC or SDC. This reduces transportation costs and helps with inventory management by minimizing the number of smaller shipments received at other facilities. I list the IFCs with the RDCs because all of the IFCs (6 of them) appear to be co-located with RDCs.

RDCs employ 325 people each, on average, and they average about 550,000 square feet in size.

Stocking and Bulk Distribution Centers

The RDCs are meant to get goods in and out pretty quickly. But naturally a company like Home Depot is going to need places to store inventory as well, which is where the Stocking and Bulk Distribution Centers come in. Here’s some footage of an SDC in Mira Loma, CA:

As the names imply, the key difference between the SDCs and the BDCs appears to be that the latter handle bulkier items, and the SDCs conveyable items.

The SDCs employ about 150 people on average, and the BDCs only about 25 each. SDCs range from 500,000 to 1.5 million square feet; the smaller BDCs from 100,000 to 300,000 square feet.

Flatbed Distribution Centers

In 2020, Home Depot began rolling out a new type of distribution center, the Flatbed Distribution Center, geared towards fulfilling large professional orders: as the press release announced, “It’s one thing to deliver a simple package the next day, or even the same day, but imagine a flatbed of 80-pound bags of concrete, concrete blocks, a bunk of lumber and then throw in some drywall to get the project done.” Pros make up about 4% of Home Depot’s customer base, but they’re responsible for 45% of sales, so Home Depot naturally wants to cater to this unique market.

FDCs are drive-thru distribution centers, and Home Depot claims that the first one they built in Dallas can accommodate 65-75 flatbed trucks/day. They are planning to build 40 FDCs in total in the 40 largest markets.

HD Supply, Redi Carpet, and SRS Distribution

Speaking of the pros, Home Depot also reacquired HD Supply in 2024, after having divested it in 2007. HD Supply provides other businesses with maintenance, repair, and operations (MRO) products and services. They will do things like supply big apartment complexes, nursing homes, hotels, etc. with replacement appliances and things to fix electrical and plumbing systems, all at wholesale prices.

Oftentimes HD Supply will fulfill big professional orders through its RDC-BDC-FDC network, but they also have their own distribution network comprised of 129 facilities, by my current count. Some of Home Depot’s largest warehouses by employee count are HD Supply facilities.

Home Depot has made two recent acquisitions that I imagine will be slowly incorporated into the operations of HD Supply: Redi Carpet in 2023 and SRS Distribution in 2024. Redi Carpet is a wholesale flooring supplier acquired in 2023 for an undisclosed amount (all cash), and SRS Distribution is a construction materials distributor acquired in 2024 for $18.25 billion. Both acquisitions are indications of the importance of the pro and business-to-business markets for Home Depot.

Redi Carpet came with about 30 distribution centers, and SRS more than 700 (SRS also had a sales force of 2,500 people and a fleet of 4,000 trucks!). I imagine both of their physical footprints will slowly shrink as operations are incorporated into that of their parent company, but I’ve included distribution facilities for Redi Carpet and SRS companies in the map as well.

Direct Fulfillment Centers

Beginning in 2014, the DFCs were created for the same purpose as all fulfillment centers: to meet e-commerce demand. Online sales constitute about 14% (and growing) of total Home Depot sales, and they have invested in self-storage lockers and curbside pick-up in stores, and most recently they’ve partnered with Walmart and Instacart for last-mile delivery.

Market Delivery Centers and Operations

MDOs, which were introduced in 2018, deal with major appliances: rather than have bulky appliances that often require professional installation routed through their stores, Home Depot is receiving appliances from vendors at their new MDO warehouses and scheduling deliveries/installations directly from there. The aim is to have MDOs in more than 100 locations eventually.

Most MDOs are small operations: 75,000 or so square feet with about 25 employees. But Home Depot also has larger Market Delivery Centers (MDCs) that are larger in size (700,000-800,000 square feet) and employment (200 employees). From what I can tell, the MDCs stock the MDOs.

The simultaneous buildout of the FDCs, MDOs, and the DFCs is an impressive feat, as Home Depot is making huge plays in both business-to-business professional orders and business-to-consumer distributional retail.

Really fascinatin how HD has built out such specialized nodes - the FDC rollout for pros is smart given they're 45% of sales but only 4% of custmers. The SRS acquisition for $18B seems massive though, wonder how they'll actualy integrate 700+ distribution centers without redundancy issues. That Supply Chain Sync software must be doing some hevy lifting to coordinate all these different facility types!